wyoming tax rate lookup

Skip to main content. Wyoming Administration Information.

Wyoming Property Tax Calculator Smartasset

State wide sales tax is 4.

. 31 rows The state sales tax rate in Wyoming is 4000. The state sales tax rate in Wyoming is 4. Quickly learn licenses that your business needs and.

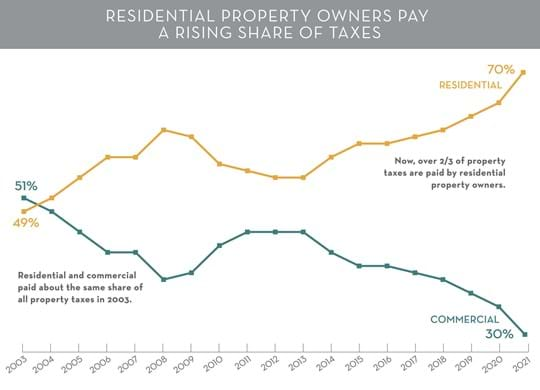

Get a quick rate range. Residential market value 100000 Residential. Residential property is assessed at 95 of market value.

Total rate range 4-6. Click the link below to access the Tax Bill Lookup. Enter your search criteria either last name address or parcel.

ZIP--ZIP code is required but the 4 is optional. Apply more accurate rates to sales tax returns. Back to Excise Tax Division.

Exact tax amount may vary for different items. Use this search tool to look up sales tax rates for any location in Washington. In Cheyenne for example the county tax rate is 1 for Laramie County.

Taxable value is the value used to calculate taxes due on your property. Wyoming ranks in 10th position in the USA for taking the lowest property tax. Effective July 1 2021 there will be an increase from 12 to 20 in the collection fee on SalesUse Tax Accounts that have been referred or will be referred to an external.

See the publications section for more information. Get information about sales tax and how it impacts your existing business processes. The median property tax in Wyoming is 105800 per year for a home worth the median value of 18400000.

Find your Wyoming combined state and local. The base state sales tax rate in Wyoming is 4. 2022 Wyoming state sales tax.

Wyoming also does not have a corporate income tax. Counties in Wyoming collect an average of. The mission of the Property Tax Division is to support train and guide local governmental agencies in the uniform assessment valuation and taxation of locally assessed property.

You can look up the local sales tax rate with TaxJars Sales Tax Calculator. The minimum combined 2022 sales tax rate for Cheyenne Wyoming is. The average property tax rate is only 057 making Wyoming the lowest property tax taker.

Small Business Administration - Wyoming. With local taxes the. Local sales tax range 0-2.

Base state sales tax rate 4. Due to varying local sales tax rates we. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

In addition Local and optional taxes can be assessed if approved by a vote of the citizens. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax. Local tax rates in Wyoming range from 0 to 2 making the sales tax range in Wyoming 4 to 6.

On the left hand side of the screen click on Tax Information Search. Tax amount varies by county. Wyoming state sales tax rate range.

Sales Use Tax Rate Charts. This is the total of state county and city sales tax rates. The Wyoming sales tax rate is currently.

Local and State Government Agencies.

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

Gross Receipts Location Code And Tax Rate Map Governments

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Pin On Ecology And That Sorta Stuff

New York Property Tax Calculator 2020 Empire Center For Public Policy

Wyoming Internet Filing System

Sales Use Tax South Dakota Department Of Revenue

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation